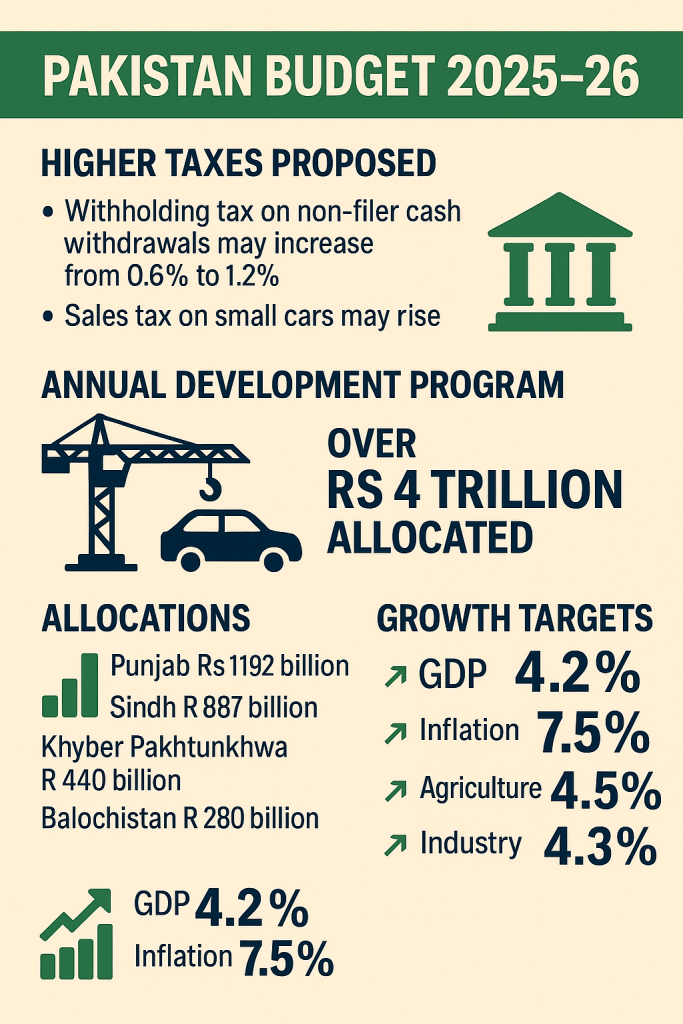

The government plans to introduce comprehensive tax reforms in the forthcoming Budget 2025-26 with focus on bank deposits, savings schemes, and even cash withdrawals.

According to Federal Board of Revenue (FBR) officials, non-filers can expect a substantial increase in withholding tax on cash withdrawals. The rate is expected to double from 0.6% to 1.2% for daily withdrawals exceeding Rs 50,000. The aim is to expand the tax net and generate more revenue from undocumented transactions.

In another blow to middle-income citizens, the government is likely to increase sales tax on small cars. Cars below 800cc, which were previously seen as affordable, might now bear extra levies. Locally manufactured cars may also witness a rise in General Sales Tax (GST) from 12.5% to 18%.

Read More: Pakistan budget 2025-26: IMF approves tax relief for salaried class

Besides, there will be increased taxation on diesel and petrol cars, as well as on capital gains and profit incomes. However, there’s some relief for big businesses, as the government is considering a reduction in super tax—subject to IMF approval.

National development program finalized

The Annual Development Program (ADP) for the upcoming fiscal year has been finalized, with over Rs 4 trillion proposed for national development. The federal Public Sector Development Programme (PSDP) will receive an estimated Rs 1,050 billion, with provinces receiving more than Rs 2,800 billion.

Proposed allocations include:

- Punjab: Rs 1,192 billion

- Sindh: Rs 887 billion

- Khyber Pakhtunkhwa: Rs 440 billion

- Balochistan: Rs 280 billion

Water and power infrastructure schemes will get Rs 259 billion, and Rs 229 billion are allocated for the National Highway Authority. The government plans to invest Rs 35 billion in the Diamer Bhasha Dam, and Rs 42 billion in education and health sectors.

Also Read: Budget 2025-26: No new tax on solar panels, confirms FBR

The national economic council, chaired by the Prime Minister, will give final approval to the plan.

For GDP growth forecast, the government is aiming for 4.2% in the next fiscal year. Inflation is expected to ease to 7.5%, with agriculture growing by 4.5%, industry by 4.3%, and services by 4.7%.

Meanwhile, Pakistan-IMF budget talks are ongoing. A recent round on May 30 didn’t lead to final decisions. Discussions are still underway on tax targets, defense spending, subsidies, and providing relief to salaried individuals.